Levy Rate Calculation

Levy Rate Calculation

Navigate: Tax > Levy Management > Tax Rate Calculation >Levy Rate Calculation

Description

The Levy Rate Calculation Wizard for Washington State streamlines the process of determining levy rates by providing an efficient and user-friendly tool. It simplifies complex calculations, ensuring accurate levy amounts while adhering to state limitations, making it an invaluable resource for local taxing districts in Washington.

Use the tax rate calculation programs to determine the levies requested by tax authorities and calculate rates for those levies based on the values provided by the Levy Value Builds.

-

Tax Rate Calculation - Calculate tax rates from levy request amounts and the levy basis from levy value builds.

-

Dependency Levy Maintenance - Maintain the requested and actual levies which will be used to calculate tax rates.

-

Optional Tax Rates - Import - Allows importing, processing, and posting of tax rates.

Calculate tax rates from levy requests amounts and the levy basis value from levy value builds, which are based on assessment rolls. A basic tax rate per unit (of value) is calculated by dividing a levy basis value (from a levy value build) into a requested levy amount. Rate calculation is a multiple-step process which uses batch processing. The final step is posting, which must be done for the rates to be available for tax calculation.

Jurisdiction Specific Information

Steps

-

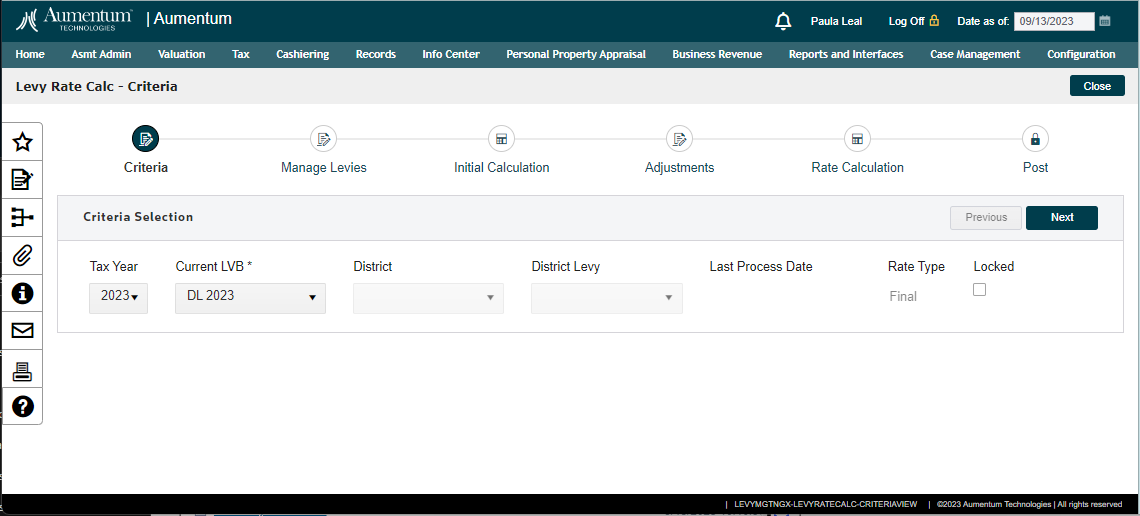

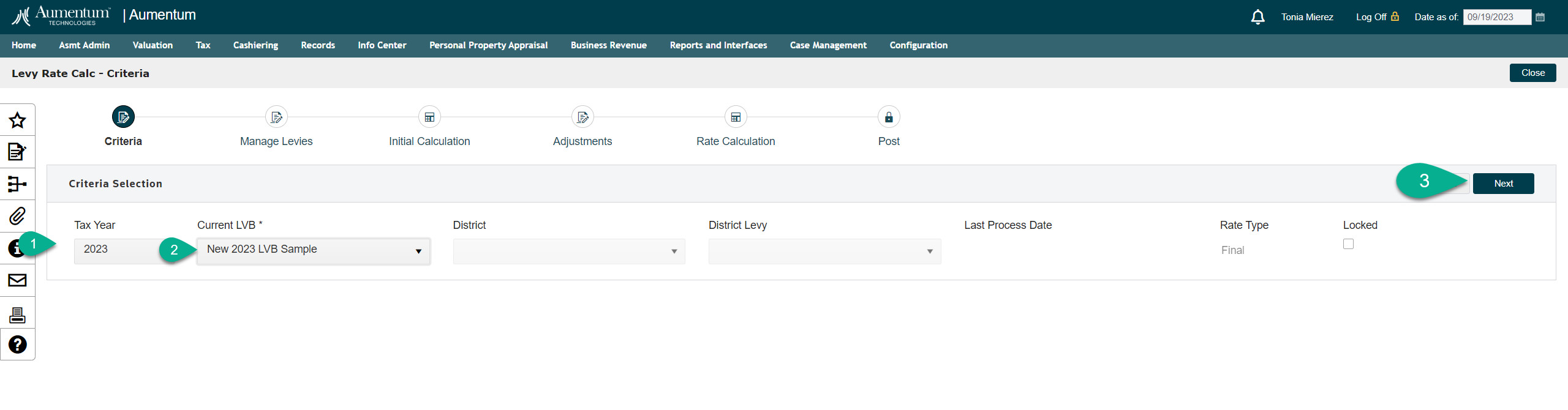

Select Criteria (Step 1)

To begin the wizard, the initial step is to carefully choose the Tax year you're interested in, followed by selecting the option for the Current Levy Value build. This specific build is designed to automatically generate all the essential aggregate values, starting from the close of the assessment roll.

-

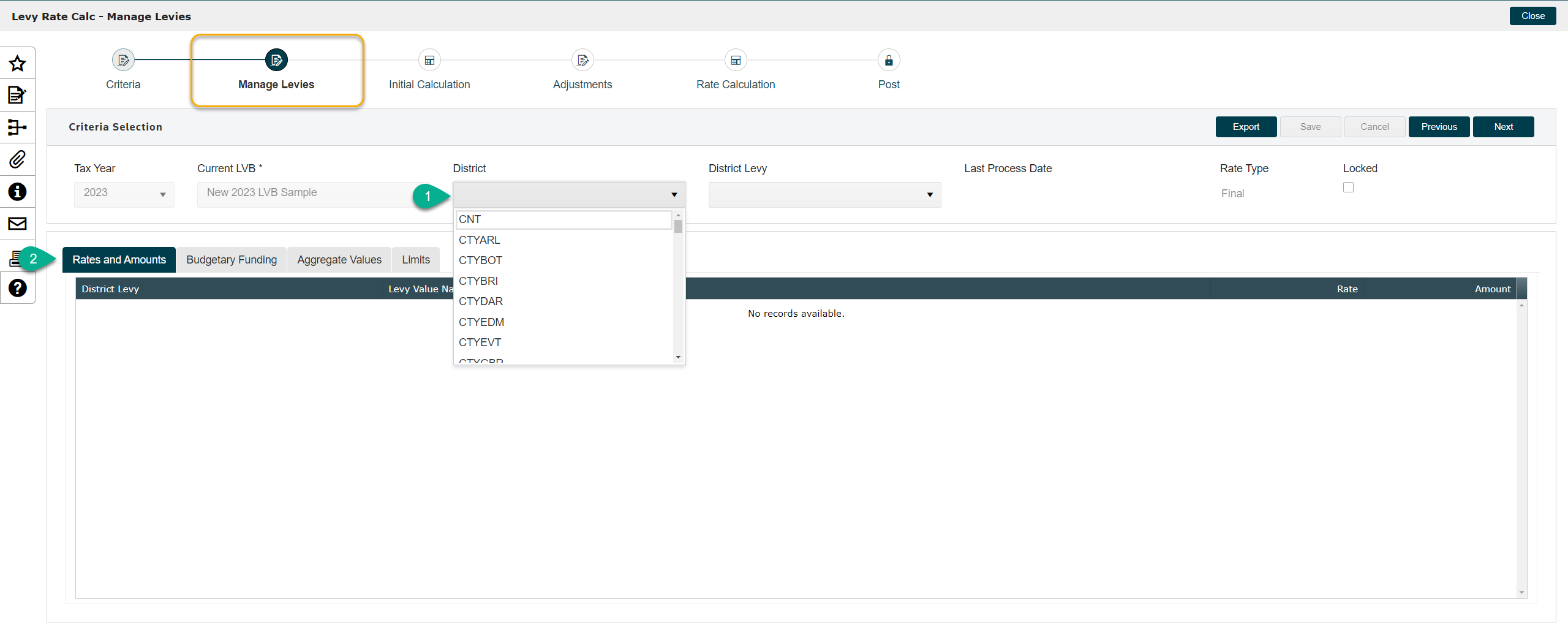

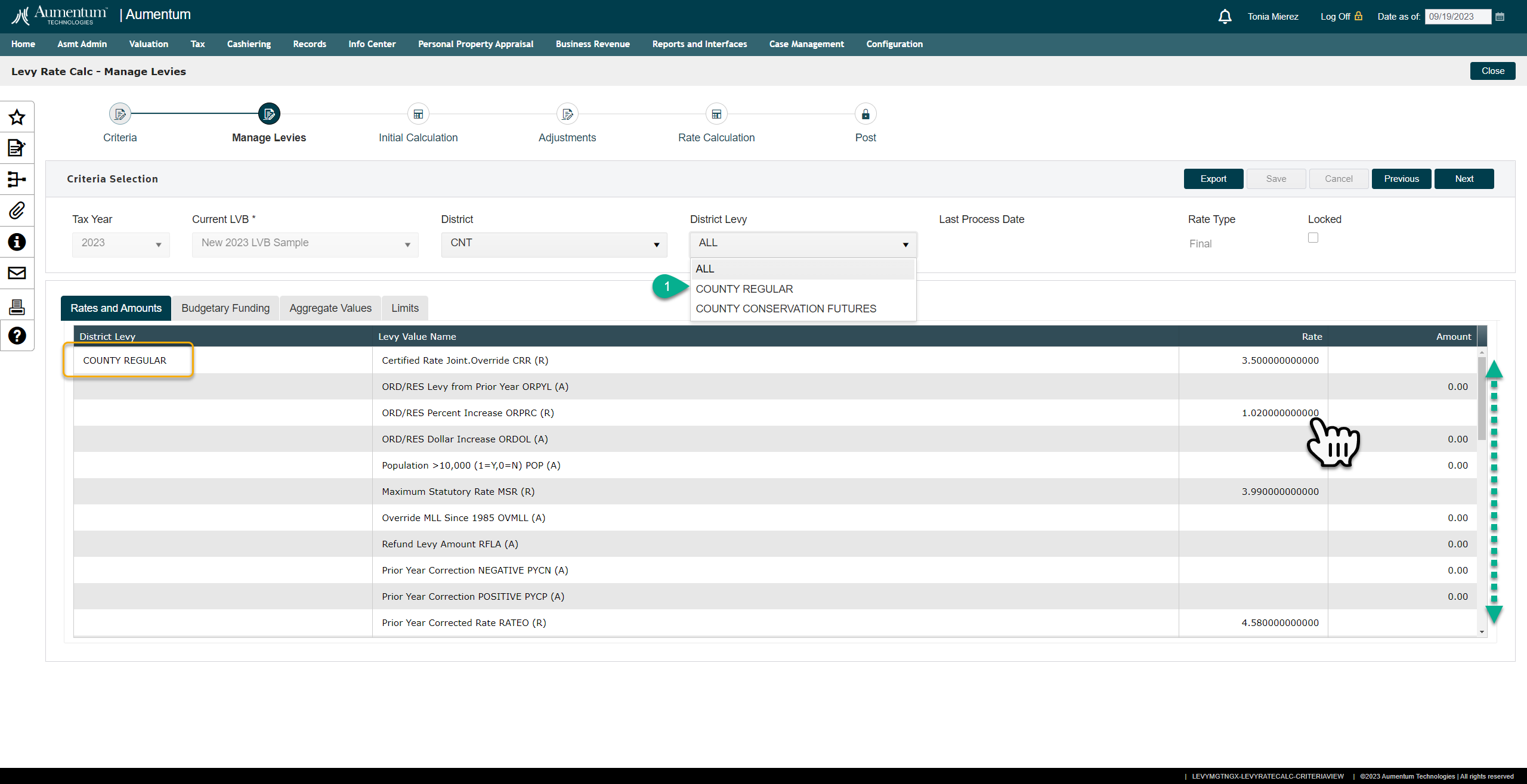

Manage Levies (Step 2)

In this step you will cycle through each District Levy to manage the Rates and Amounts, Budgetary Funding, Joint Taxing District Aggregate Values and any overrides values, amounts and/ or rates that are required for the initial rate calculations.

In the Rates and Amounts tab, you have the flexibility to filter by an individual District Levy, smoothly navigate through the grid by scrolling both up and down, and easily override any specific amounts as necessary, from prior year rates or carried forward amounts. This seamless process ensures an accurate calculation of the current year rates.

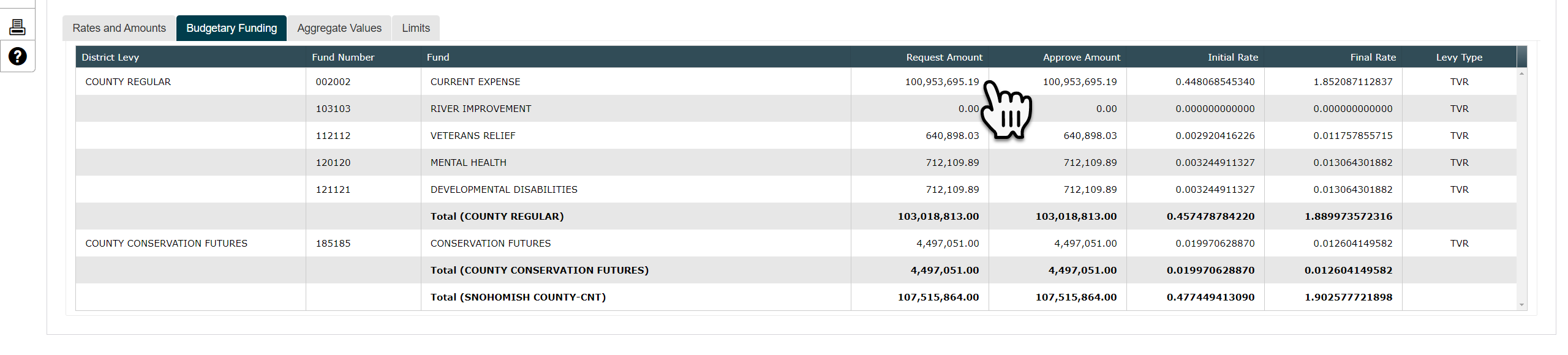

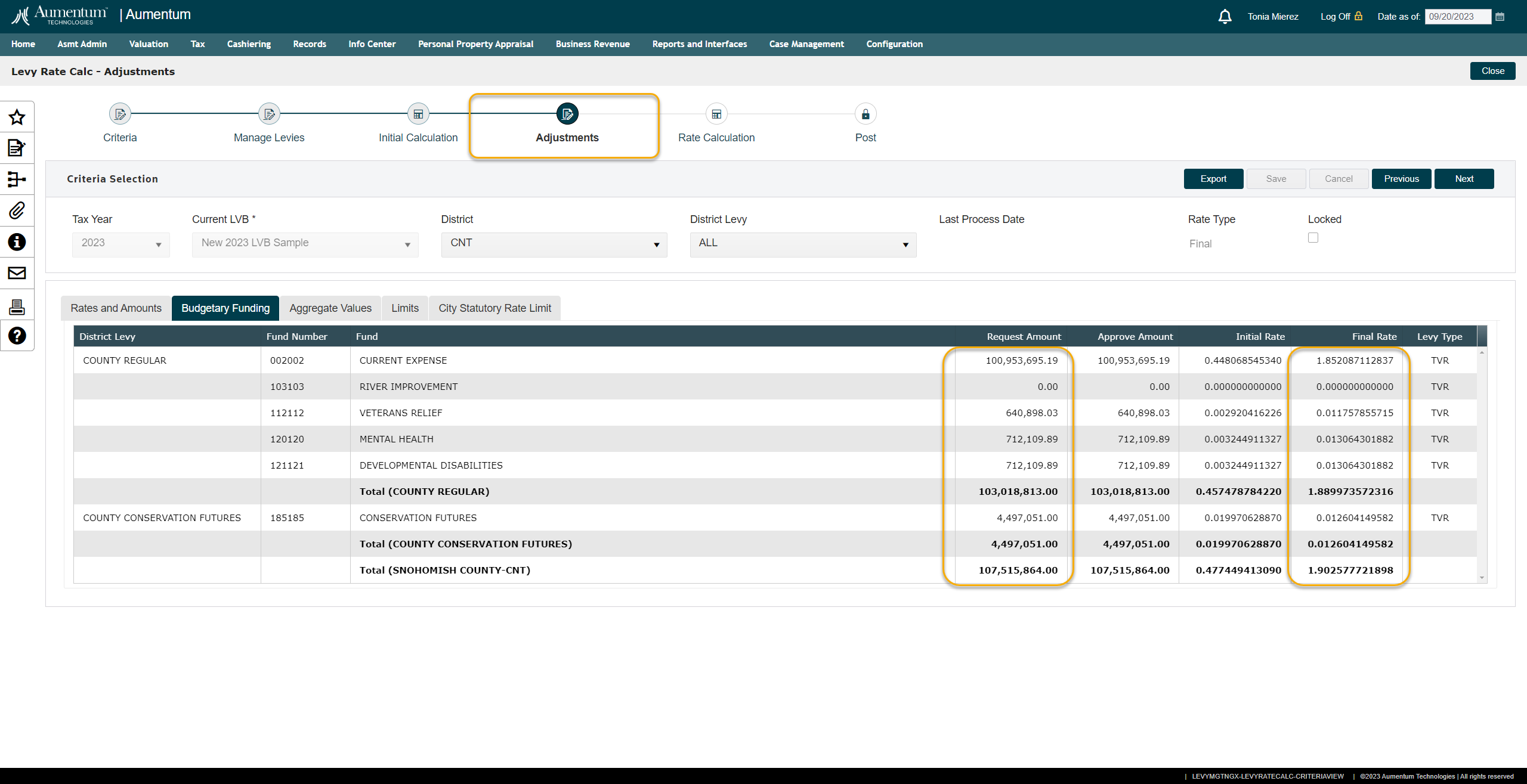

When you click on the Budgetary Funding tab in Aumentum, you'll discover a list of funds associated with the levy. Here, you can carefully review important details such as the Request Amount, Approved Amount, Initial Rate, and the Final Rate.

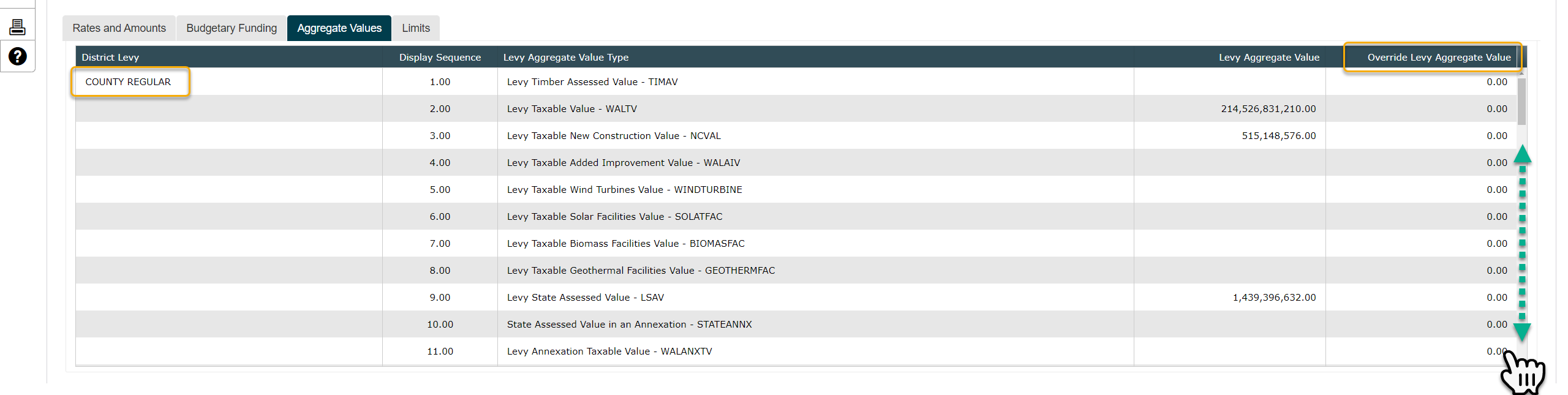

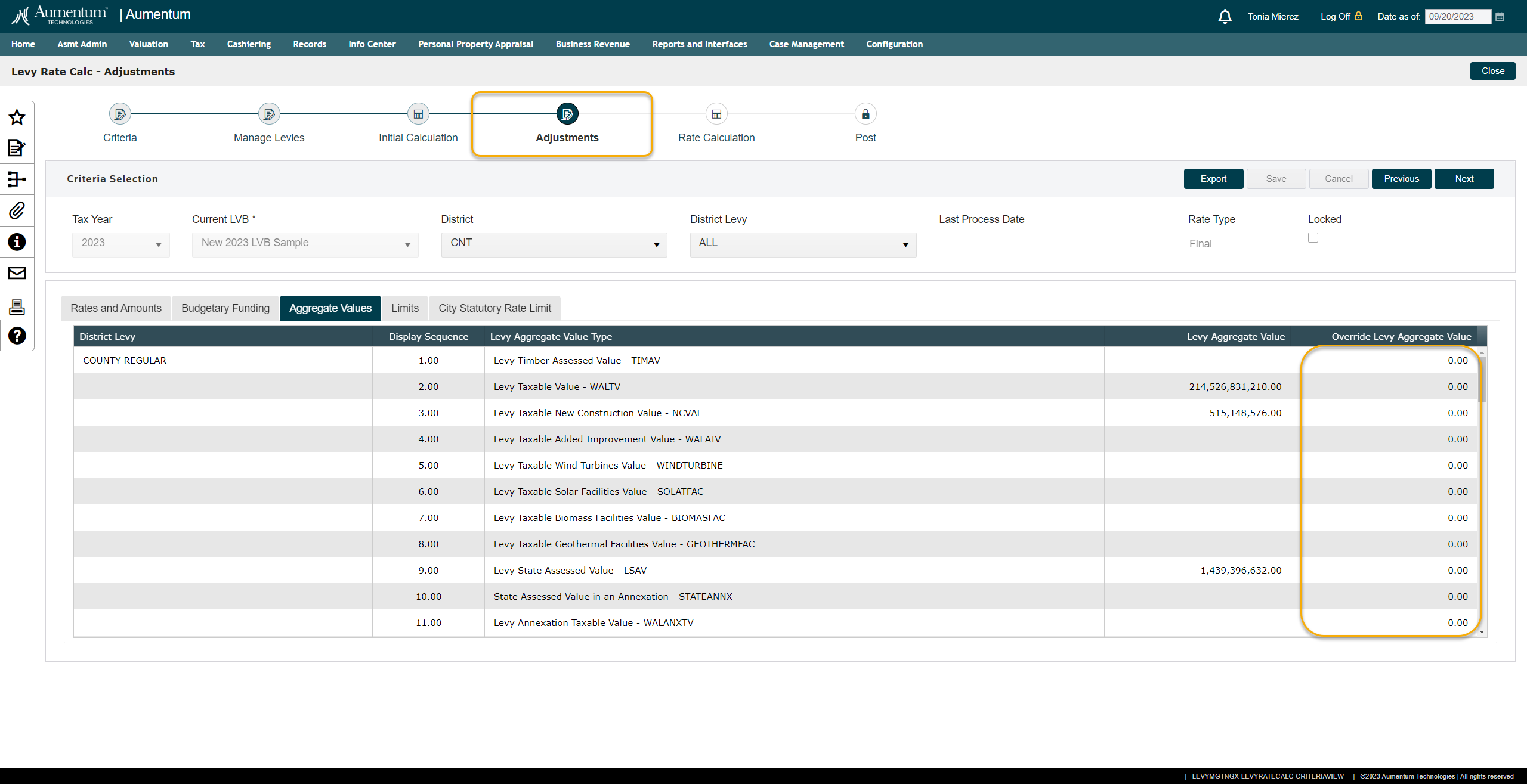

In the Aggregate Values tab you will see the values that have been combined or summarized from multiple individual data points into a single, consolidated value. This consolidation is often done to simplify complex data sets, make them more manageable, and provide a clearer overview or understanding of the data as a whole. Aggregated values can be obtained through various mathematical operations, such as summation, averaging, counting, or other relevant calculations.

For the Aumentum Levy Aggregated Values, in Levy Value Build we group like values based on the value types, levy types and district levies to combine the aggregates for proper rate calculations.

In the Aggregate Values grid you can override any value and input values for Joint Taxing Districts as needed.

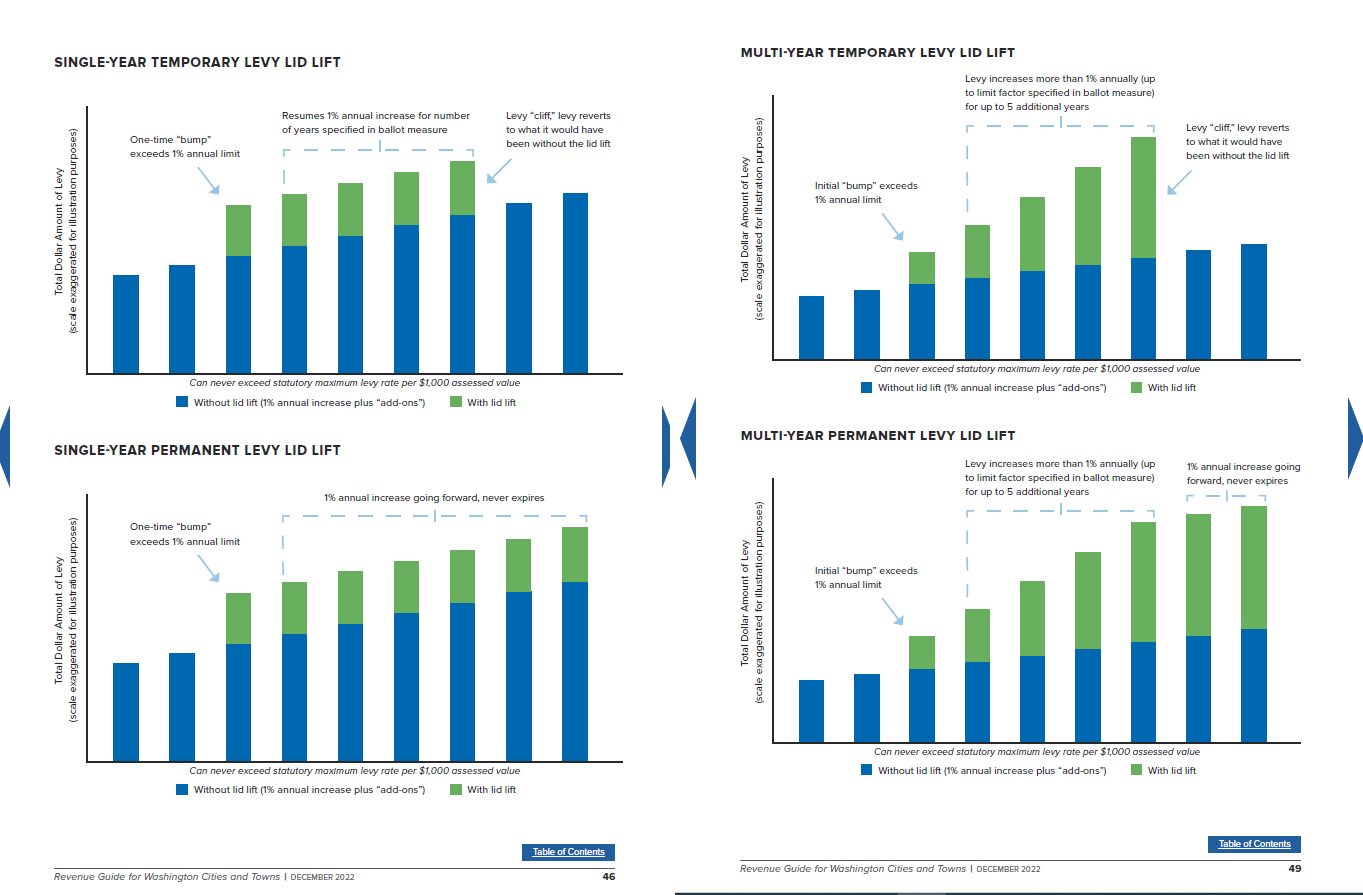

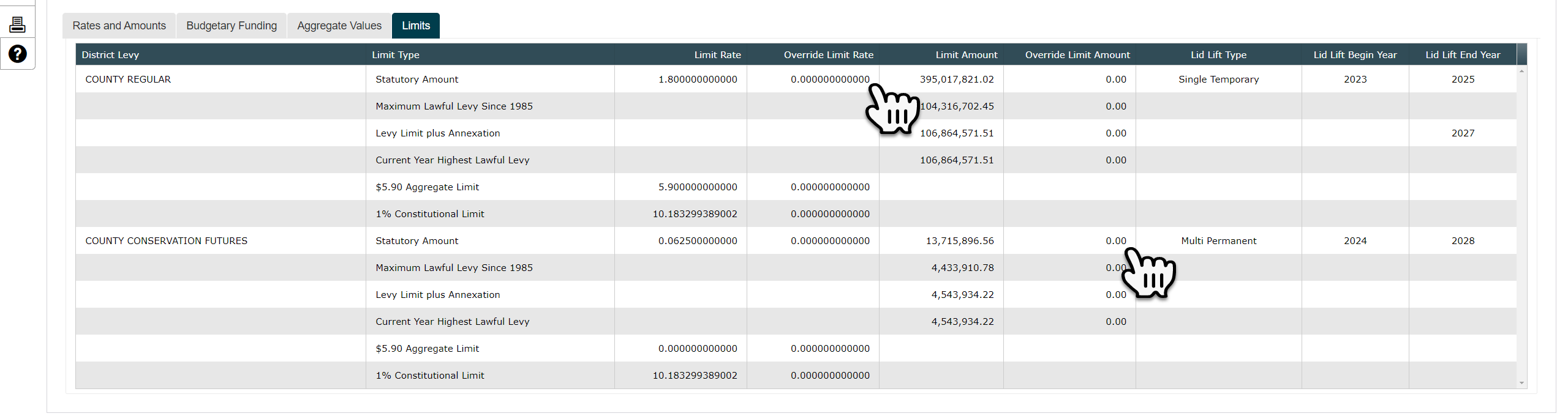

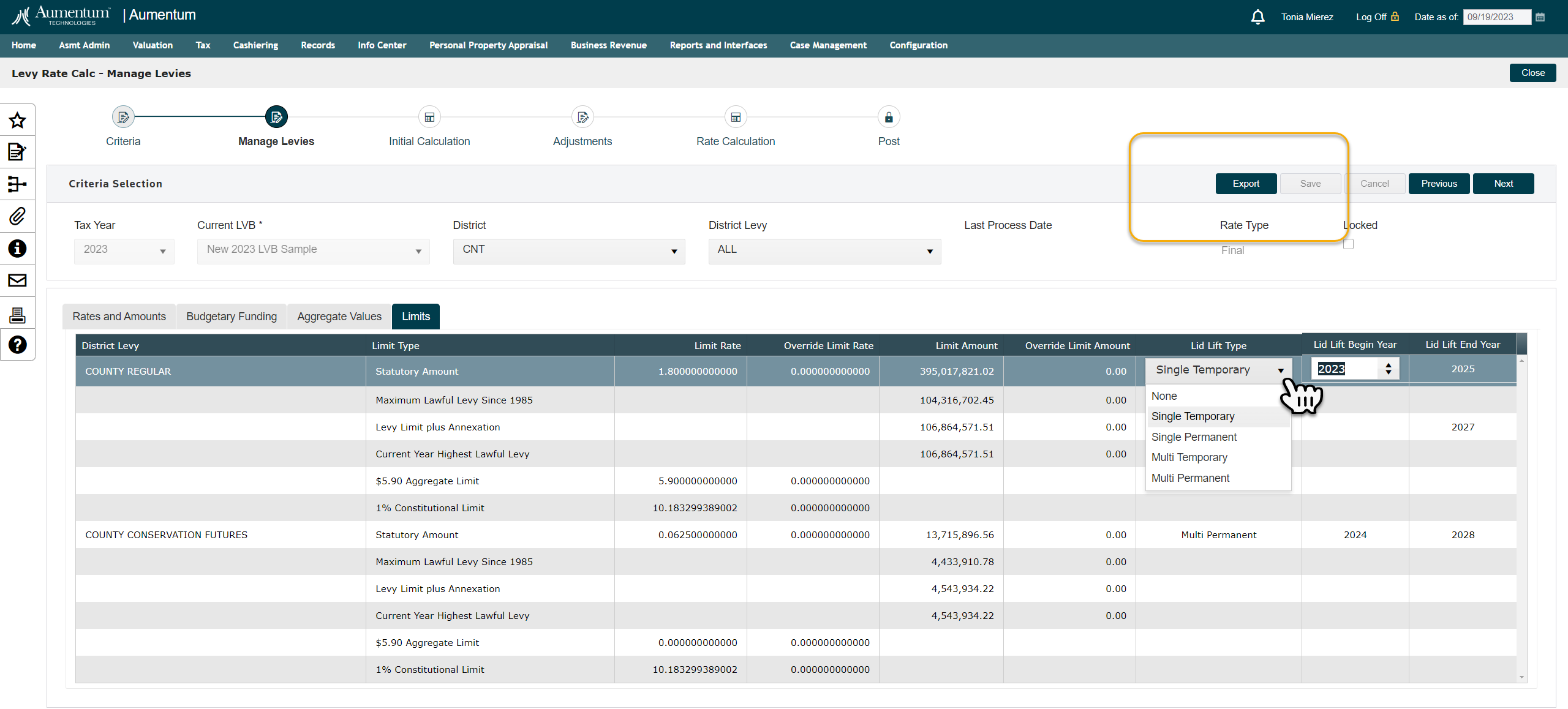

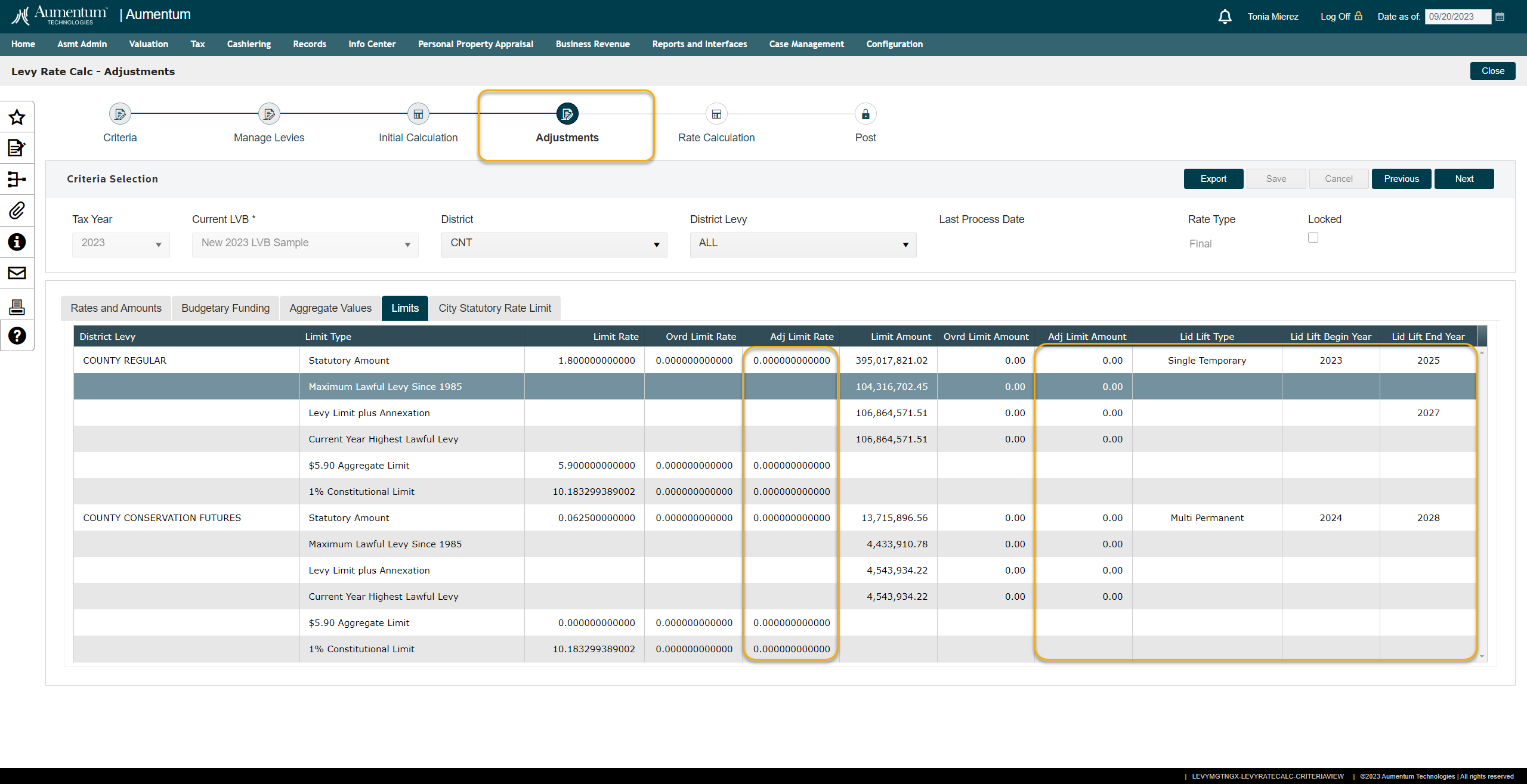

The Levy Limits tab allows for overrides of all Washington State relevant legislative Levy Limits to include LID Lift management.

-

During the "Manage Levies and Adjustments" step, users have the capability to effectively handle LID Lifts. This can be done by selecting the Type, Begin Year, End Year, and overriding limits as needed. These adjustments are specifically related to the District Levy and can be customized based on user preferences, even if they differ from the calculated amount based on user inputs.

-

-

Initial Calculation (Step 3)

In Step 3 of the Levy Rate Calculation Wizard, you will process the initial rate calculations based on the data you entered in Step 2. This step is crucial for determining various levy-related figures. Here's a detailed guide on how to use Step 3:Click the "Calculate" Button

After entering the required data in Step 2, click the "Calculate" button to initiate the initial rate calculations. This action triggers Aumentum to perform the necessary computations.

1. In the Steps tab you can monitor the multiple step process

Aumentum will provide you with a step-by-step process status update. This means you'll be able to see the progress of each calculation step as it happens. You have the option to monitor this update to ensure that all proceedings align with your expectations.

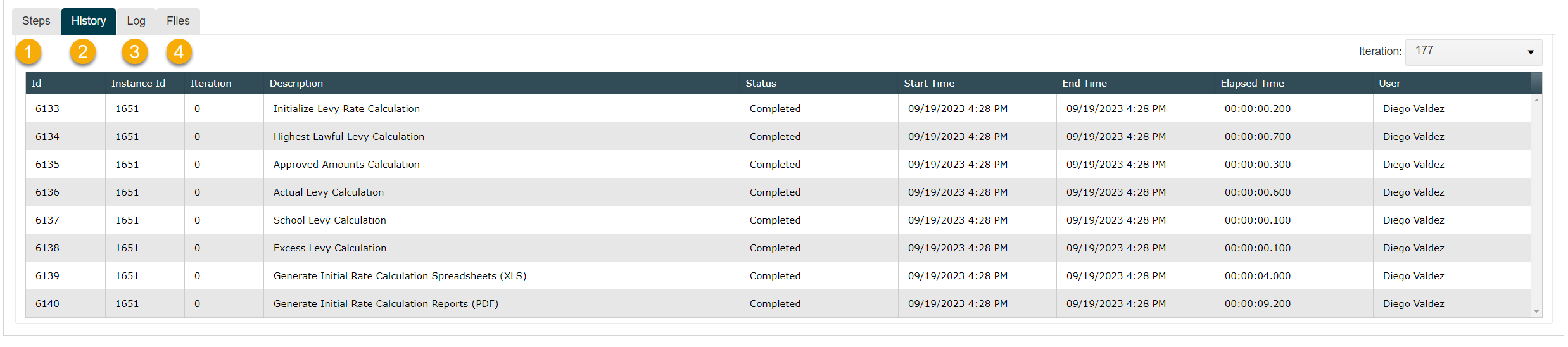

2. Access Process History in the History tab

You can review the history of the entire calculation process by navigating to the "History Tab." This tab will display a chronological record of all the steps taken during the calculations.

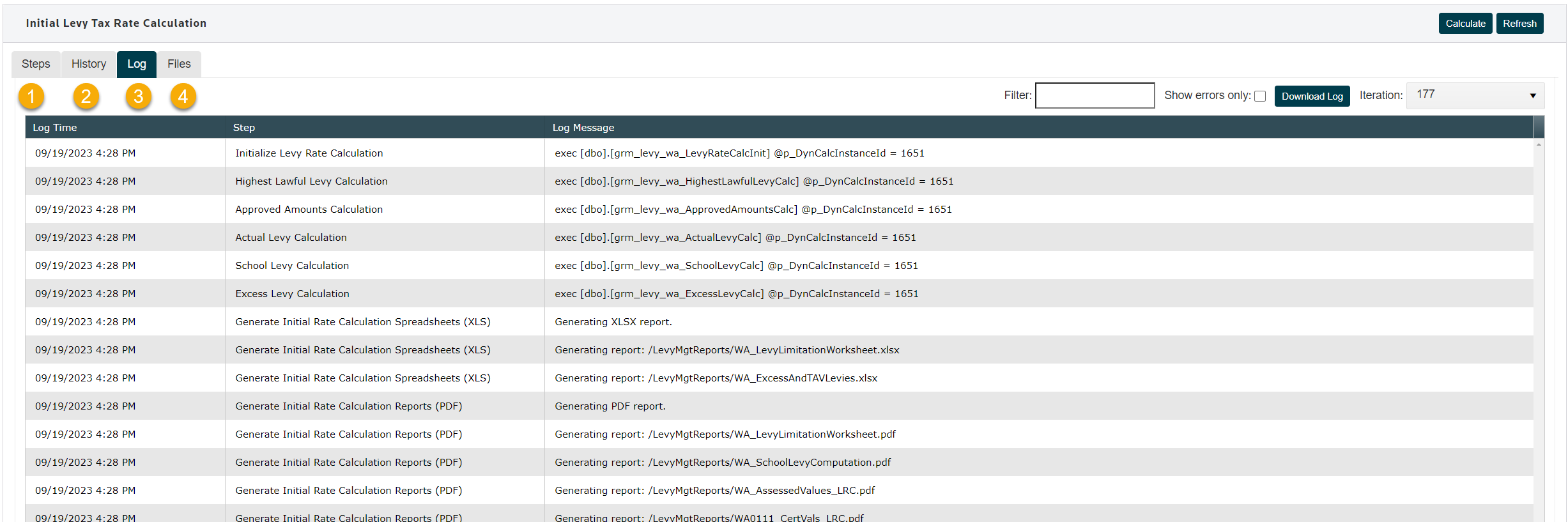

You can review the history of the entire calculation process by navigating to the "History Tab." This tab will display a chronological record of all the steps taken during the calculations.3. In the Log tab, you have the option to Troubleshoot potential issues

Aumentum also logs various details associated with the calculation process, which can be helpful for troubleshooting any issues that may arise. If you encounter problems, you can refer to these logs for insights into what went wrong.

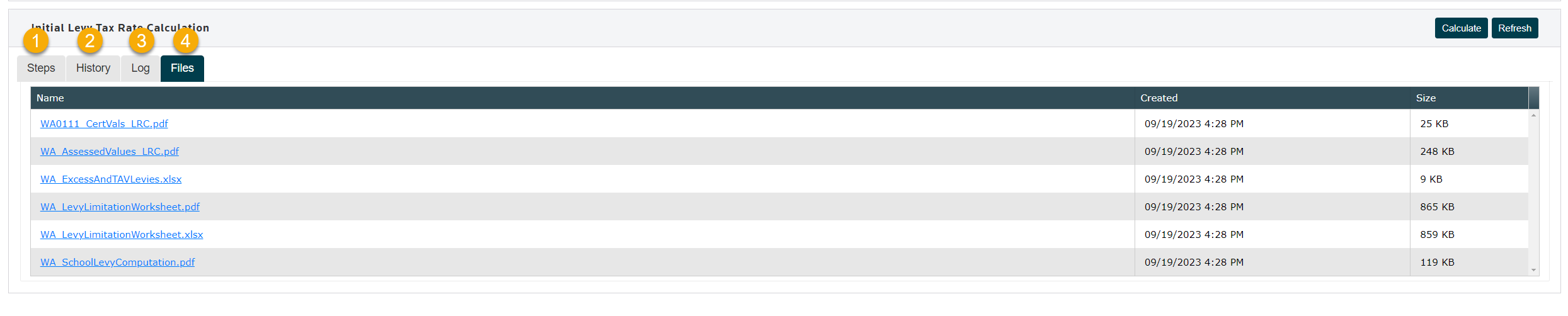

You can enter a process ID for filtering or check the Show errors only box. There is also an option to download the log for excel filtering and seamless filtering by iteration when multiple iterations have been processed.4. In the Files tab is where you can download the initial Jurisdictional reports

To access the results of the initial calculations, go to the "Files Tab." Here, Aumentum will provide a download of multiple reports containing the information you need. Specifically, you should look for the following reports:

Levy Limitations Worksheet

School Levy Computation

Certified Values

Assessed Values

Excess and TAV LeviesAfter downloading the reports, thoroughly review them to ensure accuracy and completeness. These reports will contain important information related to county dissemination and levy calculations. Any discrepancies or errors should be addressed promptly.

5. Navigation Options

If you need to revisit a previous step to change a value, rate for recalculation this can be done as many times as needed to acquire the rates you are expecting. You may also refresh the page or close the wizard for any reason, you can do so from any step within the wizard. Look for navigation options that allow you to move back to earlier steps in the process or exit the wizard entirely.

When you are satisfied and have printed all reports you can close the wizard until you are ready to proceed to the Adjustments step when you receive the Budgets back from the Jurisdictions. At this time you will navigate to step 4 for the Adjustments and Final Rate calculations.Click Next to continue

By following these steps, you'll be able to successfully process the initial rate calculations using Aumentum's Step 3. This process ensures accurate levy-related information for county dissemination and other purposes. If you encounter any difficulties or have questions, refer to the provided logs and history or consult the troubleshooting resources available in the system.

-

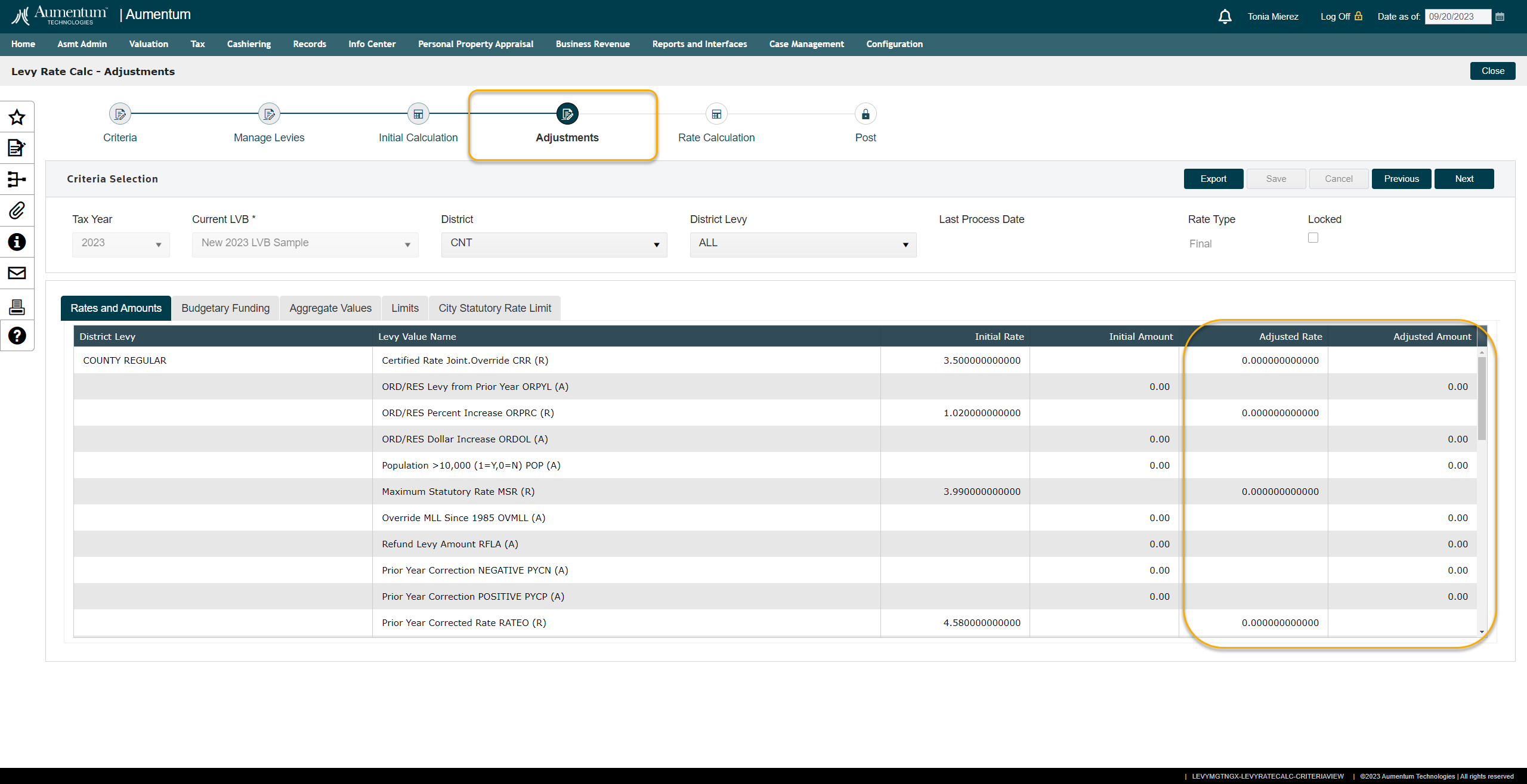

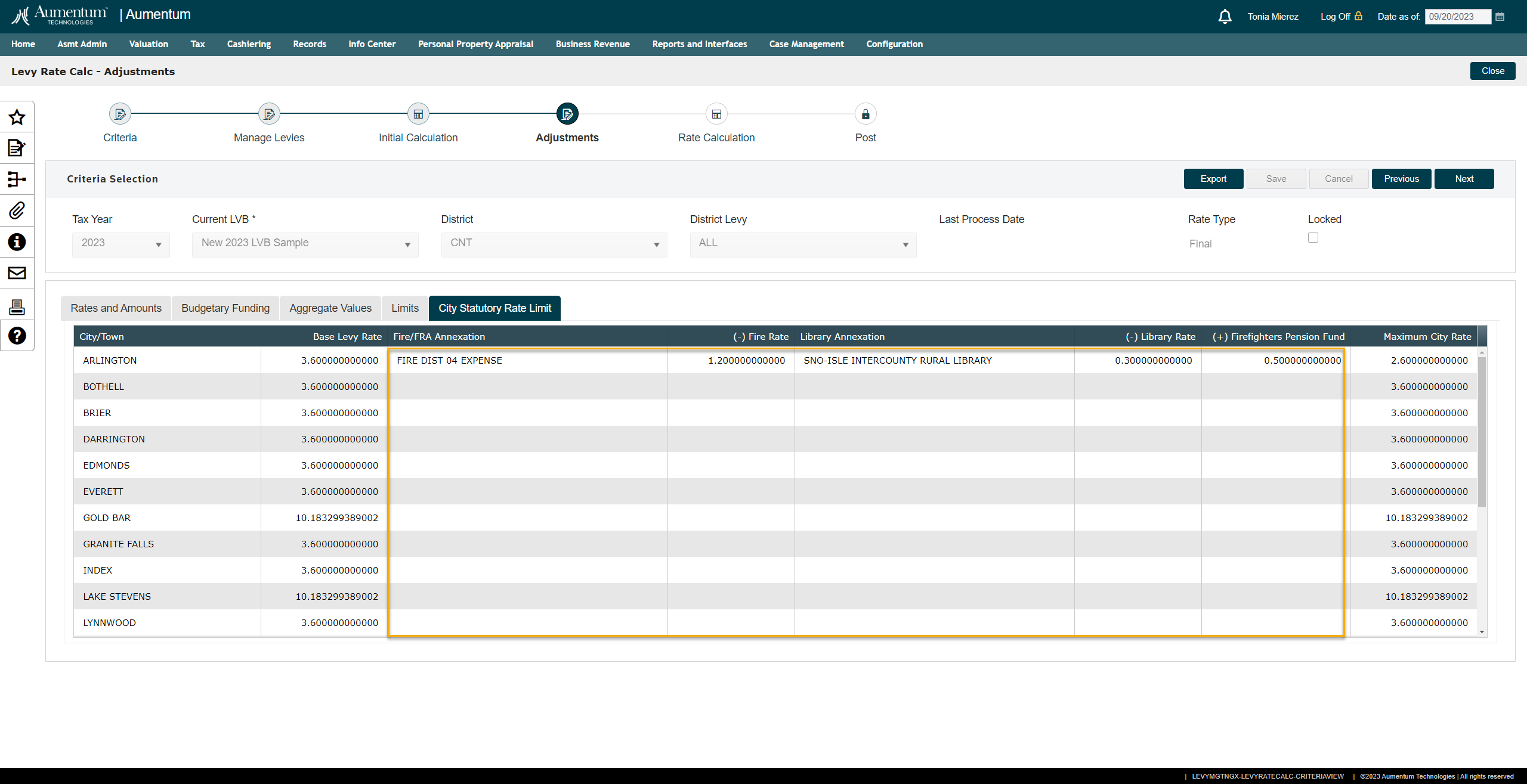

Adjustments (Step 4)

In this step of the Levy Rate Calculation Wizard, you will have the opportunity to make adjustments and overrides to various financial parameters. This step involves working with multiple tables, including Rates & Amounts, Budgetary Funding, Aggregate Values, and Limits. Here's how to proceed:

Ensure that City Statutory Dollar Rate Limits are validated according to the established rules and regulations.

After sending the initial calculations, there might be adjustments needed to the amounts and rates before the final rate calculation.-

Working with Tables

-

Within each of the tables that follow, you will possess the flexibility to control the values as circumstances dictate. The initial rates, amounts, and values will be preserved from the initial calculation process. Additionally, Aumentum will provide dedicated columns for the final rates, amounts, and override values, ensuring a transparent and comprehensive audit trail spanning across all years and rates.

-

Rates & Amounts: Adjust or override tax rates and amounts.

-

Budgetary Funding: Modify required budgetary requests or final rates for different districts or filter by District Levy.

-

Aggregate Values: Adjust or override aggregate values by district (Tax Authority) or filter by District Levy.

-

Limits: Adjust or override limit rates, amounts or LID Lifts by district (Tax Authority) or filter by District Levy.

-

City Statutory Rate Limit: Adjust or override limit rates, amounts or LID Lifts by district (Tax Authority) or filter by District Levy.

In this step of the Levy Rate Calculation Wizard, you will be responsible for managing City Statutory Rate Limits, a critical aspect of property tax levy rate calculations in Washington state. Follow these user instructions to ensure accurate and compliant calculations:

-

City Statutory Rate Limits:

-

Select the relevant Annexed Library and/ or Fire related to the city involved in the property tax levy rate calculations.

-

Aumentum will automatically write the calculated rate for the relative Library or Fire that is selected by the user

-

The basic calculation on this page is Base Levy Rate minus (-) Fire Rate minus (-) Library Rate plus (+) Firefighters Pension Fund = Maximum City Rate.

-

-

Enter any Firefighter’s Pension Fund that may be related to the respective city.

-

Enter any overrides needed for the rates for Fire and Library as required by Washington state regulations.

-

Ensure that these rates are correctly documented.

-

Click Save

-

Before proceeding to the final calculation step, meticulously review all sections in this step. Verify the accuracy and compliance of all entered rates, limits, and adjustments.

-

Proceed to the next step to Calculate final rates.

-

-

-

Export and Navigation Options

-

-

-

Rate Calculation (Final Rates Step 5)

Initiate the Calculation:-

Ensure you have completed step 4.

-

Click the "Calculate" button.

-

Monitor the Calculation Progress:

-

Observe the calculation process as it proceeds. You will receive step-by-step status updates during the initial calculations.

-

Navigate to the "History" tab to see a detailed history of the calculation process. This can be useful for reference or troubleshooting.

-

Check the "Log" tab for logs associated with the calculation process. These logs can help in identifying and resolving any issues that may arise during the calculation.

-

Go to the "Files" tab to access the reports generated during the initial calculations. There are nine reports available:

-

Levy Limitations Worksheet

-

School Levy Computation

-

Prorationing Worksheet for $5.90 Aggregate Limit

-

1% Constitutional

-

Lid Lift Calculations for Senior Citizen Worksheet

-

Levy Report for the specific year

-

Final Value for Taxes for State Levy for the specific year

-

Assessed Values, Levy Rates & Taxes for the current year

-

Certified Values

-

Review Reports for DOR Dissemination:

-

-

Carefully review the reports generated during the initial calculations.

-

Check $5.90 and 1% TCA Rate Limits:

-

Review the proof page that displays the $5.90 and 1% TCA rate limits.

-

Ensure they are accurate before proceeding to the final step of posting.

-

-

If everything looks correct, click the "Next" button to proceed to the final step.

-

If you need to make adjustments or revisit previous steps, click the "Previous" button to return to the Adjustments (Step 4) step in the wizard.

-

If Adjustments are made, you must calculate final rates again.

-

Note* You can manage rates and amounts until you have achieved the results needed prior to posting the final rates for DOR submission.

-

-

-

Post (Step 6)

In the Post step, you will review, export various data points to ensure accuracy and readiness for tax extension and post the final rates for extending taxes.

Prior to posting rates, it is recommended that the Levy Comptroller, review or export the following data elements for validation:

-

$5.90 TCA Rate Limit

-

1% TCA Rate Limit

-

TAG | District Levy | Funds and associated Rates

If there are any conflicts or issues that need to be resolved prior to posting the rates, you can now navigate to the previous steps and resolve these conflicts. Once resolved, you may proceed with the final posting.

When you are ready to finalize and lock the rates for tax extension, click the "POST" button. This action will make the final rates ready for tax extension for the new year.

Lock Override Rates and Values:

After posting the rates, the wizard will automatically "lock" the override rates and values. This means they can no longer be edited by the user to maintain data integrity.

Navigate Through Locked Data:

Even though the rates and values are locked, you will still be able to navigate through each step of the wizard to review the data that has been locked.

The user will still have access to all reports for each tax year.

Unlock Posted Levies

You may use this option to address any conflicts or changes that arise after the final posting. This feature will allow you to make adjustments as needed.

-

![]() Tips

Tips

Each rate calculation event is a unique combination of tax year, rate type, and levy. Although you can run multiple calculations on the same combination, only one rate calculation event can be posted.

In the Washington Levy Rate Calculation wizard, Aumentum maintains both the initial and final rates for comparisons throughout the annual process.

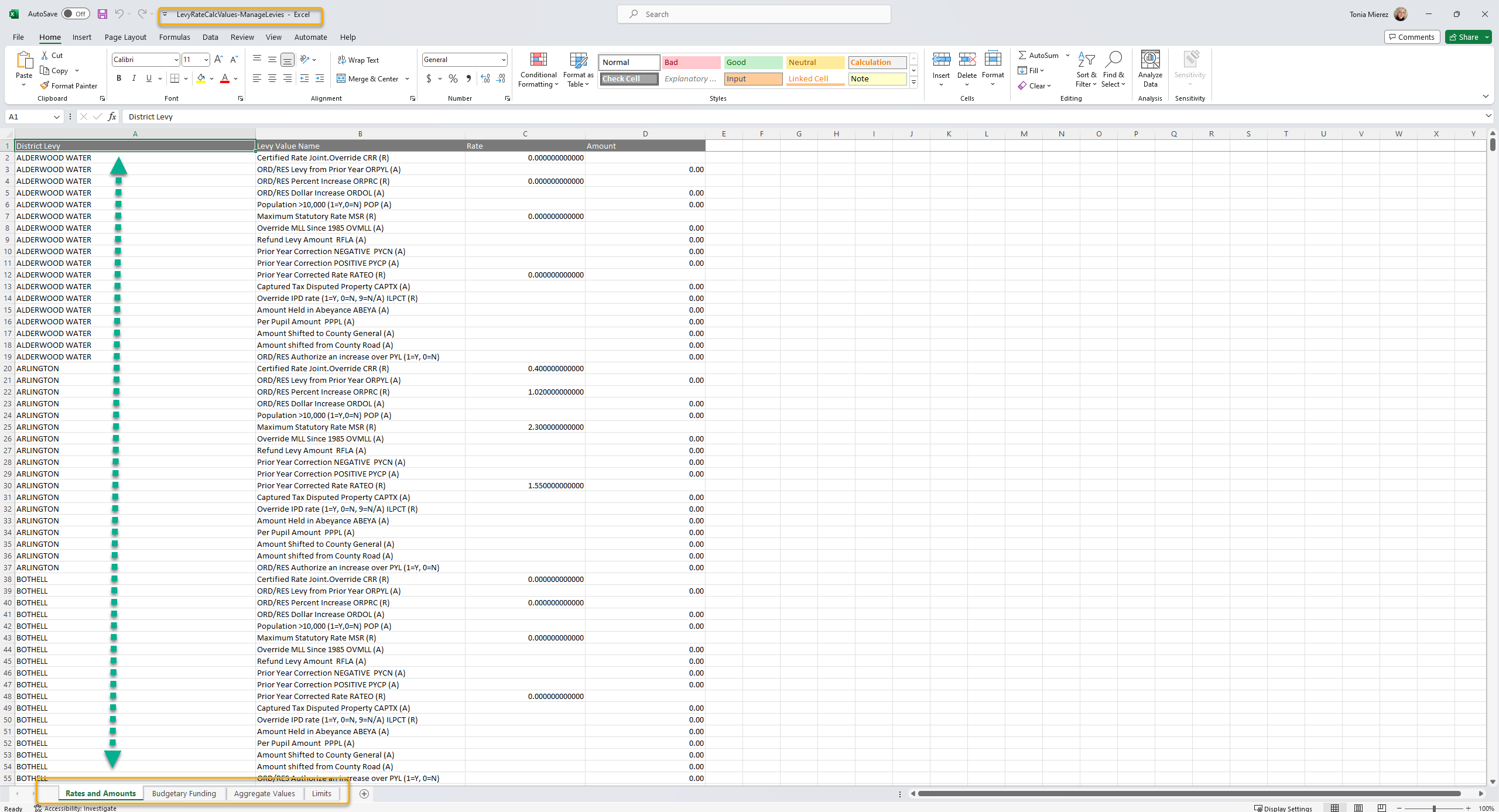

The wizard offers a convenient feature for exporting grid details. This export functionality leverages smart technology to take into account any filters applied within the grid. In the "Manage Levies" step, when you click the Export button, each tab's data will be exported, ensuring that only the filtered data is delivered to the Excel spreadsheet. This export operation neatly organizes the information into four separate tabs within the spreadsheet.

During the export process, as the system is generating the spreadsheet, you will see a busy loader on the user interface indicating that the export is in progress. Once the export is complete and the data has been compiled into the spreadsheet, the loader will disappear. At this point, you will find the spreadsheet conveniently available in your downloads folder for easy access.

![]() Valuable Vocabulary

Valuable Vocabulary

Related Topics

Rate Calculation by Tax Authority Group Report

Rate Calculation by Tax Authority Report

Prerequisites

Levy Management

-

Levy Rate Maintenance must be completed for the year prior to tax rate calculation.

-

Levy Value Build - A levy value build is required for tax rate calculation.

Configuration

The variance tolerance must be defined for tax rate calculation on the Maintain Levy Request screen.

-

Go to Configuration > Application Settings > Maintain Application Settings.

-

Select the setting type of Effective Date and the filter by module of Tax Levy Management.

-

Click Edit on the Tax Rate Variance Tolerance application setting and set the tolerance as applicable.

Dependencies

If you are using calculated rates, rather than entering rates manually for tax authority funds, rates must be calculated prior to Tax Roll Processing.

When a LID Lift exists the Levy Limitations Worksheet will be impacted in pages 1 and 2. Page 1 section D, F and J rates and page 2 sections G, I, O and P, will display the LID Lifted rates. Also, the header will display the text LID LIFTED in the top left section.